Here’s an overview of a European client looking to acquire established Airbnb properties in Riga, Latvia.

The entire process spanned 31 days. Initially, we identified a property that aligned with the client’s requirements. This step was followed by thorough tax research and negotiations over the price. The concluding phase involved facilitating the transition of the Airbnb account and managing the rental operations.

1) Buying criteria (1 day)

The first step was to have a talk with the client to find out what kind of properties they were looking for and what things they wouldn’t accept. We also decided on a budget that could change a bit, between €150,000 and €300,000 EUR.

After the call, we noted down what the buyer wanted and started our search. Our main goal was to find a property in Riga with at least a 7% cap rate before tax. The buyer needed the property to bring in money right away after buying it, so we looked mainly for Airbnb businesses that were already making money and other properties that had long-term tenants.

*Minimum Price: $150,000

*Maximum Price: $300,000 (including closing costs)

*Cap Rate: 7% or higher, pre-tax (factoring in all costs and mgmt. fees)

2) Finding properties and tax research (3 days)

Next, we used Airdna to find the right properties. We discovered two that met the client’s needs. Both were already being used for short-term rentals; one was in Riga’s Old Town and the other in the city center.

We got in touch with the agents selling these Airbnb properties to learn about their profits and costs from the current owners. We needed this information to make a better offer that would meet our goal of a 7% cap rate.

Our legal team in Riga conducted thorough research into the tax implications for running a short-term rental business in Riga, Latvia. They delved into the specific taxes the client would be responsible for and calculated the precise amounts that would be due.

3) Scheduling viewings (5 days)

Next up, we had to set up some property tours for the buyer. This meant a bit of back and forth for five days to nail down a date that worked for everyone to do the viewings.

On the day we picked, the buyer took a full day to check out all the properties on the list. Getting a real-life look at each place was super important. It gave the buyer a better sense of each spot, helping them make a more solid decision.

4) Offer, negotiation and due diligence (7 days)

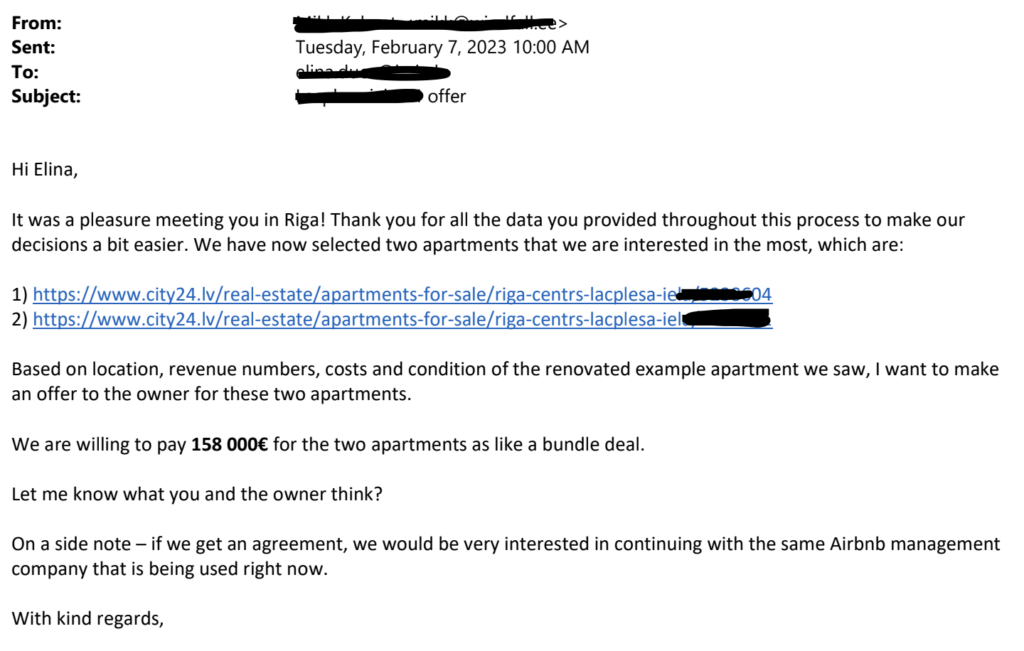

The buyer expressed a keen interest in acquiring two condominiums, both of which were under the ownership of the same individual. These properties caught the buyer’s attention due to their location, features, and potential for yielding a good return on investment.

Initially, the seller had set the asking price for these condominiums at €172,000. This price point was based on various factors, including the market value, the condition of the properties, and the prevailing real estate trends in the area.

Recognizing the opportunity for negotiation, we entered into detailed discussions with the seller. Our goal was to secure a more favorable deal for our client. We employed various negotiation strategies, including highlighting the benefits of a swift sale and the buyer’s readiness to proceed.

After a series of negotiations, marked by back-and-forth discussions and careful consideration of the properties’ worth, we successfully managed to reduce the asking price. The final agreed-upon price for the purchase of both condominiums was €158,000. This successful negotiation not only represented a significant saving for the buyer but also demonstrated our commitment to advocating for our client’s best interests and achieving optimal outcomes in property acquisition deals.

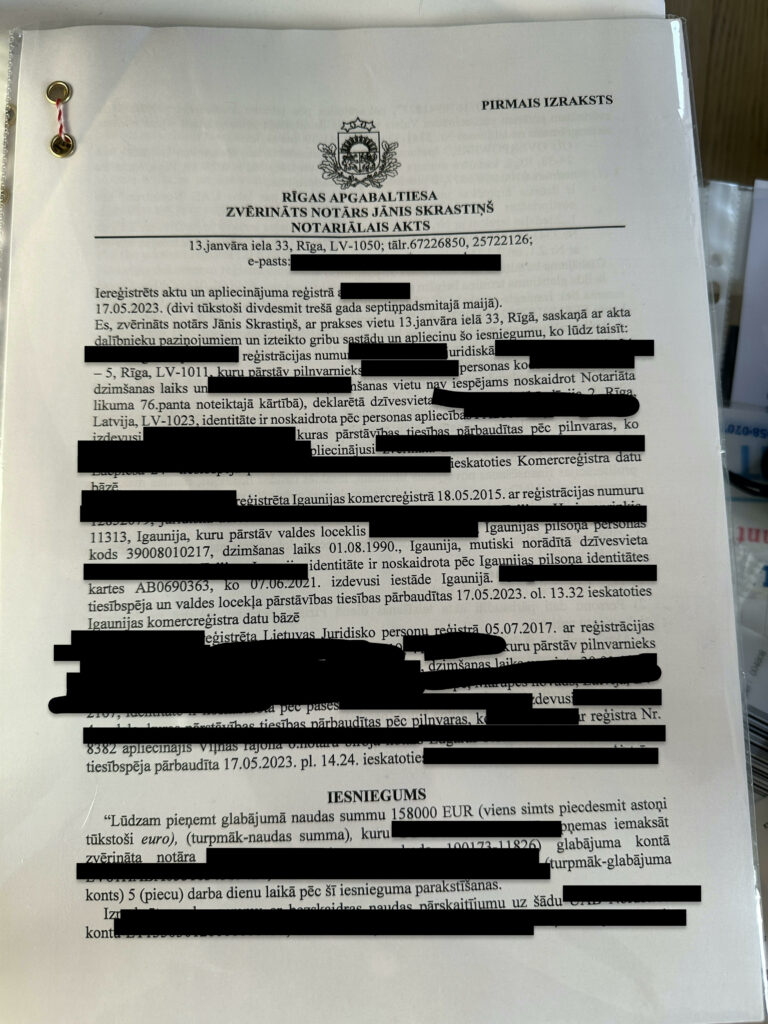

Following this, a 5% deposit was necessary to initiate the due diligence process.

To safeguard the buyer’s interests, we opted for an escrow service. This step ensured that the deposit was securely held and would only be released under agreed conditions, thereby minimizing any financial risks for the buyer.

We then embarked on a comprehensive due diligence investigation. This critical phase involved a detailed analysis of the profit and loss statements, providing insights into the financial performance of the properties. Additionally, we arranged for a professional appraisal of the flats. This appraisal aimed to determine the fair market value of the two apartments, ensuring that our client was making an informed and financially sound investment decision.

5) Buying Process (14 days)

After the offer was accepted and the due diligence came back clear, we moved closer to wrapping up the deal.

The buying process turned out to be pretty straightforward. Since the buyer already had an EU company, he could make the purchase through his existing Polish company. This saved both time and money.

Fortunately, there was no need for the owner to set up a subsidiary in Latvia; buying through the Polish company was enough.

We still needed to provide proof of the source of the funds, which took about 5 days to get verified.

It’s worth noting that for foreign individual buyers, setting up a company isn’t necessary for this process.

6) Closing the deal in Notary (1 day)

The last step was to transfer the funds and finalize everything at the Notary’s office.

For property purchases in Latvia, the Notary is usually based in Riga, meaning a trip there is needed.

As the buyer was nearby, he just flew to Riga in the morning, sorted things out at the notary, and flew back home the same day.

One month later, the owner was able to obtain a title deed, guaranteeing full ownership.

7) Rental management and daily cashflow

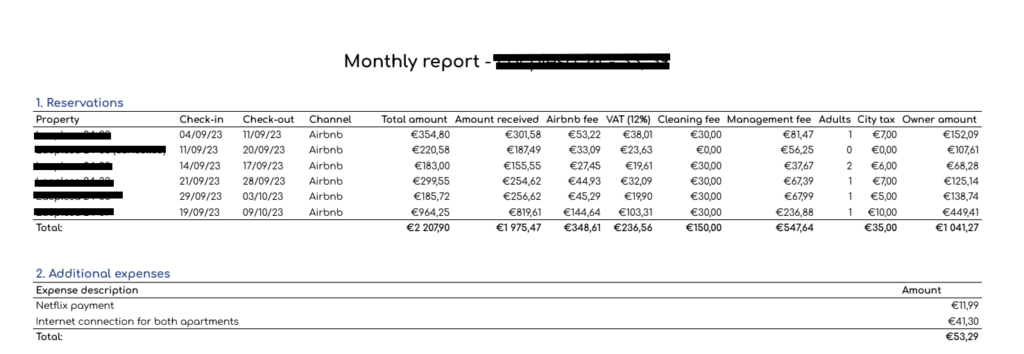

To make things easy for the buyer, we agreed to keep the existing property manager, who had great reviews for this property (a 5.00+ rating from over 70 reviews).

The deal was that the rental management would take care of everything – cleaning, day-to-day management, and sending monthly profit and loss statements to the owner, with profits going straight into his bank account.

Interested in investing in high-yield, short-term rental properties abroad? Reach out to us! Our team specializes in guiding clients through the complexities of purchasing in foreign markets, navigating the challenges faced by international buyers, and dealing with local bureaucracy.